Dear Readers Welcome to Back to Another New Blog Post on Cryptojackmoney.com. Today We will Tell You the 8 Best Low-Spread Forex Brokers for Investing and Trading in 2024.

In the fast-paced world of Forex trading, choosing the right broker is crucial for success. One of the key factors traders consider is the spread, which is the difference between the bid and ask prices of a currency pair.

Low spreads can significantly impact profitability, especially for high-frequency traders and scalpers. In this article, we review the best low-spread Forex brokers for 2024, highlighting their features, advantages, and potential drawbacks to help you make an informed decision.

So First Of All:

What are Low-Spread Brokers?

A low-spread broker is a forex broker who charges a tiny spread between a currency pair’s ask and bid prices. This is known as a spread, one of the most essential elements that traders must consider when selecting a broker. A narrow spread can imply great liquidity and moderate volatility, whereas a broad spread can indicate poor liquidity and high volatility.

Here are the 8 Best Low-Spread Forex Brokers for Trading in 2024

- IC Markets: Best and Low Forex Fees.

- CMC Markets: Low withdrawal fee. FX spreads are competitive.

- Pepperstone: Best Forex Broker & CFD Trading Platform.

- Forex.com: Forex. Trade over 80 FX pairs, with a EUR/USD spread of as little as 0.0 and low commissions.

- eToro: Free stock and ETF trading.

- Plus500: Lowest Forex Spread for Major Currency Pairs

- FXTM (ForexTime): Best With High Floating Leverage and Fast Execution.

- Saxo Bank: Best and Trusted Forex Broker

Best Low Spread Forex Brokers Details Reviewed

Choosing a low-spread Forex broker is critical for increasing trading efficiency while reducing costs. Here are eight of the finest Forex firms with low spreads for investing and trading in 2024:

Supported markets, for example, require a minimum deposit and follow regulations.

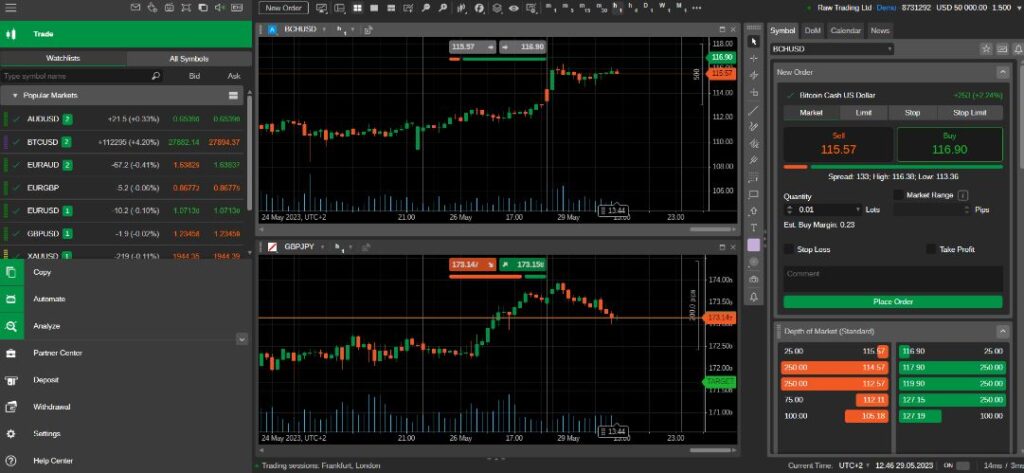

1. IC Markets

IC Markets Global is one of the best Forex CFD providers, offering trading solutions for active day traders, scalpers, and newcomers to the Forex market. IC Markets Global provides its clients cutting-edge trading platforms, low-latency connectivity, and excellent liquidity.

IC Markets Global is reinventing online forex trading. Traders can now have access to pricing that was previously restricted to investment banks and high-net-worth individuals.

- Spread: Start at 0.0 pips on the MetaTrader 4 and 5 platforms with the average on EURUSD being 0.1 pips 24/5.

- Maximum Leverage: Up to 1:500

- Currency Pair: IC Markets you’re able to trade up to 65 currency pairs. The EUR/USD, the GBP/USD, the AUD/USD, and the USD/JPY are considered major currency pairs.

- Minimum Deposit: $200

- Average Trading Cost EUR/USD: 0.1 pips

- Average Trading Cost GBP/USD: 1.0 pips

- Regulation: FSA (Financial Services Authority of Seychelles), ASIC in Australia

- Established: January 30, 2007, Sydney, Australia

| Advantages 1. Ultra-low spreads starting from 0.0 pips. 2. High liquidity and fast execution. 3. Wide range of trading platforms (MT4, MT5, and cTrader). | Disadvantages We have limited educational resources. It is a somewhat complex fee structure for beginners. |

2. CMC Markets

CMC Markets provides a variety of trading platforms, including proprietary platforms, mobile trading applications, and MetaTrader 4. The company also offers risk-management tools to help traders control their risk and maximize profits. Some of the features include guaranteed stop-loss orders (GSLOs) for a fee, which can be fully repaid if the GSLO is not activated.

CMC Markets is overseen by the Financial Conduct Authority (FCA), a UK regulatory organization responsible for upholding fair market standards for both individuals and corporations.

CMC Markets claims to provide competitive spreads on a wide range of financial instruments, including forex, indices, commodities, and treasuries. Spreads are the difference between the buy and sell prices of a financial instrument, and narrower spreads are often regarded as less hazardous. According to CMC Markets, currency spreads start at 0.7 points for EUR/USD and USD/JPY, and 1.0 points for the FTSE 100 and DAX 30 indexes.

- Spread: Starting from just 0.7 points for EUR/USD

- Maximum leverage (retail clients): 30:1

- Maximum leverage (professional clients): 1:500

- Currency Pair: CMC Markets offers trading on seven Forex currency pairs. EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD.

- Regulation: Monetary Authority of Singapore (MAS) and Australian Securities & Investment Commission (ASIC), AFBD

- Established: 1989

| Advantages 1. Low forex fees 2. Great web and mobile platforms 3. Advanced research and educational tools | Disadvantages High stock CFD fees Only CFDs are available Customer support only 24/5 |

3. Pepperstone

Pepperstone provides the most comprehensive trading experience in the online FX broker community. The broker’s lightning-fast execution systems, different account kinds, competitive pricing, and multiple platforms (MT4, MT5, and complete cTrader capability) outperform the great majority of global forex brokers.

Pepperstone, utilized by over 400,000 traders worldwide, has some of the lowest spreads on the market. Opening a Razor account will result in minimum spreads of 0.0 pips on several pairs. This contains the EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CHF. To achieve the best spreads, consumers should trade during peak market hours.

- Spread: 0.0 pips

- Maximum leverage (retail clients): 30:1

- Maximum leverage (professional clients): 500:1

- Currency Pair: AUD/USD, EUR/ USD, GBP/USD, USD/CAD

- Regulation: CYSEC, ASIC, DFSA, BAFIN, CMA

- Established: 2010 in Melbourne, Australia

| Disadvantages Mostly CFDs offered MetaTrader platform is a basic Slow live chat | Disadvantages Mostly CFDs offered MetaTrader platform is basic Slow live chat |

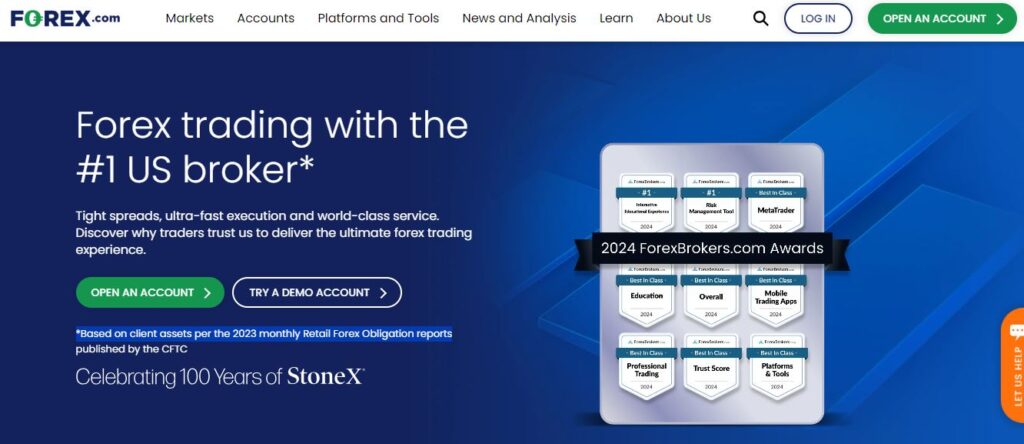

4. Forex.com

FOREX.com, formed in 2001 as part of GAIN Capital Holdings, is a well-known global online broker that caters to consumers looking to trade the retail FX and CFD markets. StoneX Group Inc. bought GAIN Capital Holdings, which includes City Index, an online CFD and spread betting provider, and Daniels Trading, a futures advice trading firm, in February 2020.

Forex.com also provides a proprietary trading platform and mobile app with Trading Central services. A six-tier active trader program allows high-volume traders to minimize their trading expenses. Forex.com has over $1.4 billion in equity capital and over $7.2 billion in customer assets, making it one of the safest brokers.

Forex.com is a registered forex broker established in 2001. It covers over 80 currency pairs and has low pricing. However, spreads frequently vary depending on the trader’s location and account type. For example, US clients seeking low-spread forex brokers can open a Direct Market Access (DMA) account, which provides institutional-grade spreads for a minimal charge.

- Spread: 0.8 pips

- Maximum leverage (retail clients): 50:1

- Currency Pair: It supports more than 80 currency pairs

- Regulation: NFA, CFTC

- Established: 2001

| Advantages 1. Low forex fees 2. Great variety of currency pairs 3. Diverse technical research tools 4. Spreads from 0.8 pips 5. Proprietary trading platform and MT4. | Disadvantages Product portfolio limited to forex and CFDs High stock CFD fees Desktop platform not user-friendly No 3rd party copy trading (MT4 signals aside) Higher spreads compared to ECN brokers. |

5. eToro

eToro is a market-leading multi-asset online brokerage and social trading network that allows you to buy and sell popular cryptocurrencies while copying professional crypto traders’ trades on the platform. eToro is a low-spread forex broker with forex trading fees starting at just 1.0 pip for the popular EUR/USD pair.

The eToro platform provides traders and investors with access to over 5,000 financial assets, including stocks, cryptocurrencies, ETFs, indices, currencies, and commodities, all of which can be invested in with or without leverage, allowing almost anyone to access short-, mid-, and long-term investment opportunities.

- Spreads From EUR/USD: 1.0 pips

- Maximum leverage (retail clients): 1:500

- Currency Pairs: 40+ (EURUSD, USDJPY, GBPUSD and USDCHF)

- Regulators: FCA, CYSEC

- Established: January 2007, Tel Aviv-Yafo, Israel

- Minimum Deposits: $100

- A/C Opening Fees: 0%

| Advantages 1. Spreads from 1.0 pips for forex CFDs 2. Low overnight fees 3. Powerful charting platform 4. Free stock and ETF trading 5. Seamless account opening | Disadvantages $5 withdrawal fee $10 per month fee after 12 months of inactivity No limit orders for stocks. |

6. Plus500

Plus500 is a global multi-asset fintech company that runs proprietary technology-based trading platforms. Our market-leading technology fuels our products, operations, and marketing programs, while our customer-centric approach, economic model, and leadership teams allow us to generate attractive returns for stakeholders.

This makes Plus500 a fantastic option for avid futures traders. A highly trusted broker, there are 13 currency futures to trade, ranging from Micro AUD/USD and Micro GBP/USD to Mexican Peso and Euro FX, with leverage based on margin.

- Spreads: 0.8 pips

- Maximum Leverage for Retail Traders: 30:1

- Currency Pair: 60 + forex pairs (EUR/USD, EUR/GBP, EUR/AUD, EUR/NZD, EUR/CAD, EUR/CHF, GBP/USD, and AUD/USD)

- Regulators: ASIC, CFD, FCA, FMA

- Established: Founded in 2008

- Minimum Deposit: $100

| Advantages 1. A free demo account Allows beginners to practice trading strategies without risking real money 2. Low commissions Plus500 offers share dealing with low commissions 3. Regulated Plus500 is regulated by the Financial Conduct Authority (FCA) in the UK, which is considered a Tier 1 regulator by FXEmpire | Disadvantages No MT4 or MT5 platform support No phone support Plus500 doesn’t offer customer support by phone CFD trading Some say that CFD trading means users don’t actually receive cryptocurrency |

7. FXTM (ForexTime)

FXTM, often known as ForexTime, is a global online broker that trades financial assets such as forex, commodities, indices, stocks, and cryptocurrency. FXTM was founded in 2011 by Andrey Dashin and is located in Mauritius. It has over 2 million clients globally.

FXTM offers gold traders three assets: the XAU/USD, XAU/EUR, and XAU/GBP. It is a good choice for Forex traders that incorporate gold into their diversification plan. It is also ideal for pure gold traders seeking cross-currency trading opportunities. While the minimal spread with a commission-based ECN account starts at 5.0 pips, FXTM averages 33.0 pips. The FXTM ECN MT5 account shows 9.0 and 15.0 pips, respectively. FXTM traders can pick between MT4 and MT5, enhanced with six add-ons.

- Spread: 0.8 pips

- Currency Pair: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD

- Maximum Leverage: 1:2000

- Regulators: Financial Services Commission of Mauritius, CMA, CySEC, FCA, and FSCA

- Minimum Deposit Required: $10

- Established: 2011

| Advantages 1. A highly regulated broker with a tier-1 license 2. Digital and fast account opening 3. Low fees 4. Excellent commission-based Forex pricing environment and transparency | Disadvantages Poor education services Inactivity and withdrawal fees No cryptocurrencies and limited choice of commodities |

8. Saxo Bank

Saxo Bank is an online trading platform that connects investors and traders to the worldwide financial markets. Saxo Bank provides a variety of financial instruments, such as equities, ETFs, mutual funds, bonds, and futures. The website also includes real-time pricing, research, and trading tools to assist investors in making informed selections.

Saxo Bank charges a transaction fee in many countries when consumers buy or sell, however account setup is free. Saxo Bank also reduced the price of numerous types of securities in 2024.

- Spreads: 0.6 pips

- Maximum Leverage for Retail Traders: 1:30

- Currency Pair: 140+ currency pairs

- Regulators: FSA, FINMA, FCA

- Established: Founded in Denmark in 1992

- Minimum Deposit: $0

| Advantages 1. Interest paid on uninvested cash 2. Offers complex order types and account protection features to seamlessly manage risk. 3. Broad product portfolio | Disadvantages High options and futures fees Custody fee charged No 24/7 customer service |

Additional Tips for Selecting a Forex Broker

- Regulation: Always choose brokers regulated by reputable authorities.

- Trading Platform: Ensure the platform meets your trading needs and is user-friendly.

- Customer Support: Reliable and accessible customer support can make a significant difference.

- Leverage: Consider the leverage options and choose one that aligns with your risk management strategy.

- Educational Resources: Opt for brokers that offer extensive educational materials if you are new to trading.

Conclusion

Choosing the right forex broker is a critical step in ensuring your success as a trader. The brokers highlighted in this article—IC Markets, CMC Markets, Pepperstone, Forex.com, eToro, Plus500, FXTM, and Saxo Bank—stand out for their low spreads, regulatory compliance, and robust trading platforms. These factors collectively reduce trading costs and enhance your overall trading experience.

When choosing a broker, you should consider not only the spreads but also the other characteristics that are important to your trading approach and goals. Regulation, leverage options, customer support, and the availability of instructional resources can all have a big impact on your trading efficiency and profitability.

Low-spread brokers can make a significant impact, particularly for high-frequency traders and scalpers who rely on low spreads to maximize profits. Each broker listed here has distinct advantages and potential drawbacks, so it’s critical to select one that best suits your specific trading requirements.

FAQs

What are low-spread forex brokers?

Low-spread forex brokers offer trading accounts with minimal differences between the bid and ask prices, which reduces trading costs.

How do low-spread forex brokers make money?

Low-spread brokers typically make money through commissions, swap fees, and additional services rather than wider spreads.

What factors should be considered when choosing a low-spread forex broker?

Factors include regulatory status, trading platform, commission structure, customer support, and the range of available currency pairs.