Today I’m going show you the 10 Best Solar Power Stocks to invest their money in 2024, First of all, In the face of climate change, solar stocks have enormous long-term potential. Solar currently accounts for less than 4% of total electricity output in the United States, leaving many possibilities for expansion in the coming years.

If you believe in the future of solar power and can look past the current volatility caused by increased energy prices, Cryptojacksmoney would like to share our picks for the finest solar power stocks to consider right now.

10 Best Solar Power Stocks

| Stocks (Ticker) | Market Capitalization |

|---|---|

| NextEra Energy, Inc. (NEE) | $154.89 billion |

| SolarEdge Technologies, Inc. (SEDG) | $2.65 billion |

| First Solar, Inc. (FSLR) | $28.62 billion |

| Enphase Energy, Inc. (ENPH) | $16.70 billion |

| Brookfield Renewable Partners L.P. (BEP) | $10.52 billion |

| Canadian Solar Inc. (CSIQ) | $1.15 billion |

| SunPower Corporation (SPWR) | $581.71 million |

| Sunrun Inc. (RUN) | $2.98 billion |

| Daqo New Energy (DQ) | $1.32 billion |

| Array Technologies (ARRY) | $2.04 billion |

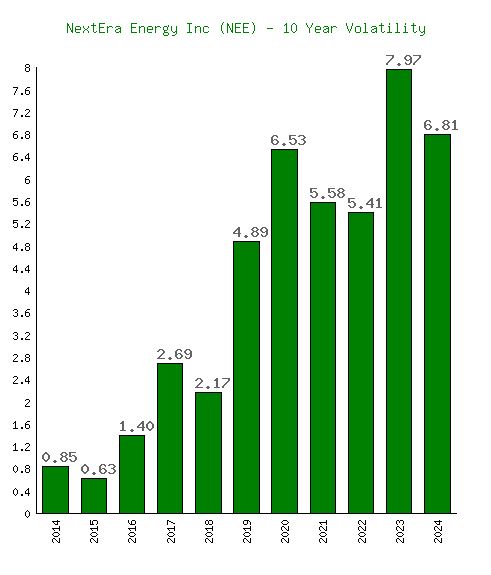

1. NextEra Energy, Inc. (NEE)

NextEra Energy, Inc. is an American energy corporation with around 58 GW of generating capacity (24 GW of which came from fossil fuel sources), revenues of more than $18 billion in 2020, and approximately 14,900 people across the United States and Canada. It is the world’s largest electric utility holding company by market capitalization, valued at more than $120 billion in November 2023.

NextEra Energy was founded in 1925 as Florida Power & Light, followed by the founding of FPL Group in 1984.

- PE Ratio (TTM): 20.55

- Dividend Yield: 2.73%

- Revenue in 2023: $28 billion

- 5-Year Annualized Return: 11.01%

- 10 years Annualized Return: 15.22%

Historical Chart

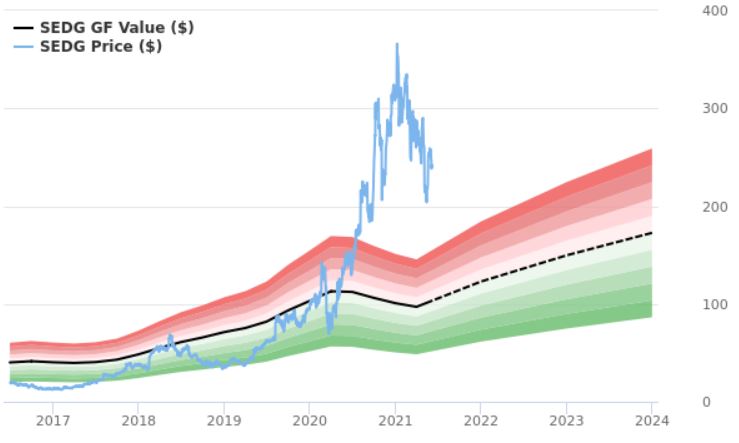

2. SolarEdge Technologies, Inc. (SEDG)

SolarEdge Technologies, Inc. is a company that has developed a DC-optimized inverter system.

The business was the first to successfully commercialize Power Optimizers, which provide module-level maximum power point tracking (MPPT) before feeding the generated electricity back into an inverter.

Guy Sella, Lior Handelsman, Yoav Galin, Meir Adest, and Amir Fishelov founded SolarEdge in 2006.SolarEdge raised $126 million in March 2015 through an initial public offering of 7,000,000 shares of its common stock for $18.00 per share. The shares started trading on the NASDAQ Global Select Market under the “SEDG.”

- P/E ratio: 10.7

- Dividend Yield: 0.00%

- Revenue in 2023: $2.98 Billion

7-Year Historical Graph

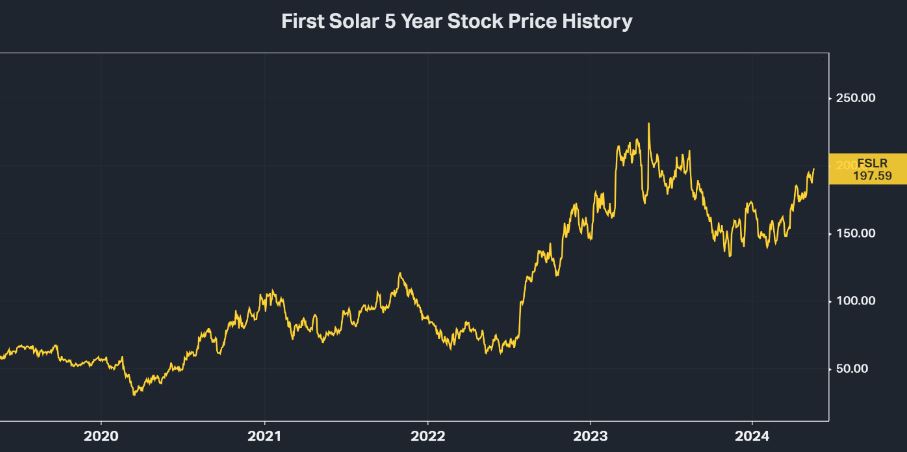

3. First Solar, Inc. (FSLR)

First Solar, Inc. is a publicly listed American solar panel manufacturer that also provides utility-scale PV power plants and related services such as funding, building, maintenance, and end-of-life panel recycling.

First Solar manufactures solar panels employing rigid thin-film modules and cadmium telluride (CdTe) as semiconductors. Inventor Harold McMaster founded Solar Cells, Inc. in 1990, followed by the Florida Corporation in 1993, with JD Polk. True North Partners, LLC purchased it in 1999 and changed its name to First Solar, Inc.

First Solar was the first solar panel manufacturer to reduce manufacturing costs to one dollar per watt in 2009. First Solar was named sixth on Fast Company’s list of the world’s 50 most innovative companies in 2012, and as of 2022, it was the fourth-largest solar company by 12-month trailing sales.

- P/E Ratio: 27.88

- Revenue in 2023: $3.319 Billion

5-Year Historical chart

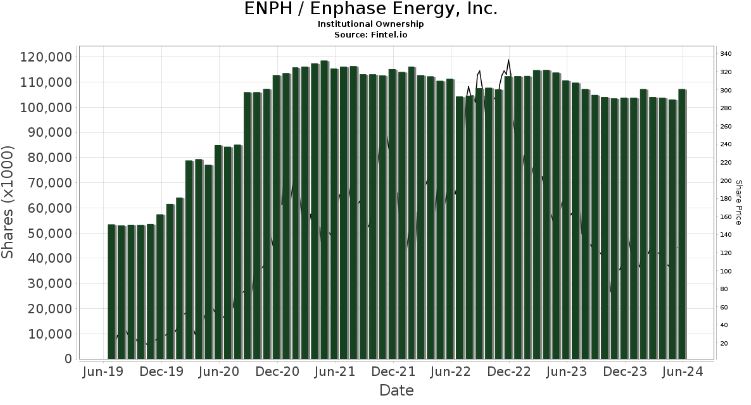

4. Enphase Energy, Inc. (ENPH)

Enphase Energy, Inc. is an American energy technology business based in Fremont, California, that principally makes solar micro-inverters, battery energy storage, and EV charging stations for residential use. Enphase was founded in 2006 and is the first firm to commercially market the solar micro-inverter, which transforms direct current (DC) power from a solar panel to grid-compatible alternating current (AC) for use or export. Over 48 million microinverters have been sold to 2.5 million solar systems in over 140 countries.

Enphase’s leadership changed in September 2017, when President and CEO Paul Nahi announced his retirement from the company. Badri Kothandaraman was named the company’s new president and CEO. Kothandaraman formerly served as the company’s chief operational officer.

- PE Ratio (TTM): 68.96

- Revenue 2023: $2.291 Billion

5 Year Chart History

5. Brookfield Renewable Partners L.P. (BEP)

Brookfield Renewable Partners L.P. is a publicly traded limited partnership that owns and runs renewable energy assets, with its corporate headquarters in Toronto, Ontario, Canada. It is 60% owned by Brookfield Asset Management.

Brookfield Renewable owned roughly 200 hydroelectric plants, 100 wind farms, 550 solar facilities, and four storage facilities at the end of 2017, totaling approximately 16,400 MW of installed capacity.

In 2012, the business and its financial partners paid Alcoa $600 million for four hydroelectric power projects in the southeast United States.

In 2014, the company and its investment partners purchased a portfolio of wind-generating assets in Ireland, establishing its footprint in Europe for a total enterprise value of around $960 million.

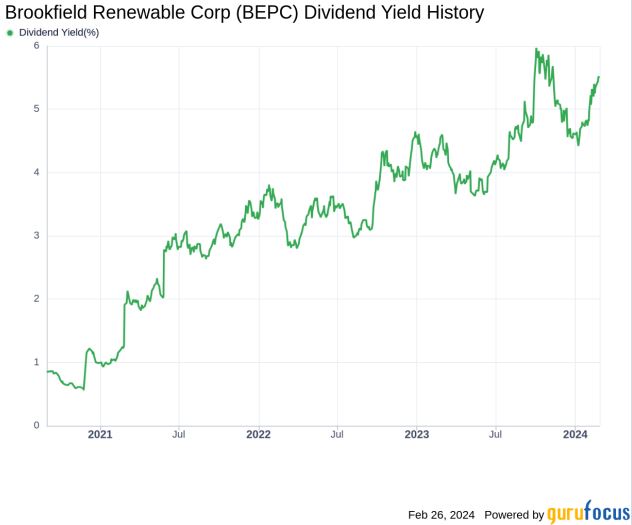

- P/S Ratio: 1.43

- Dividend Yield: 5.33%

- Revenue in 2023: $5.709 Billion

5-Year Chart History

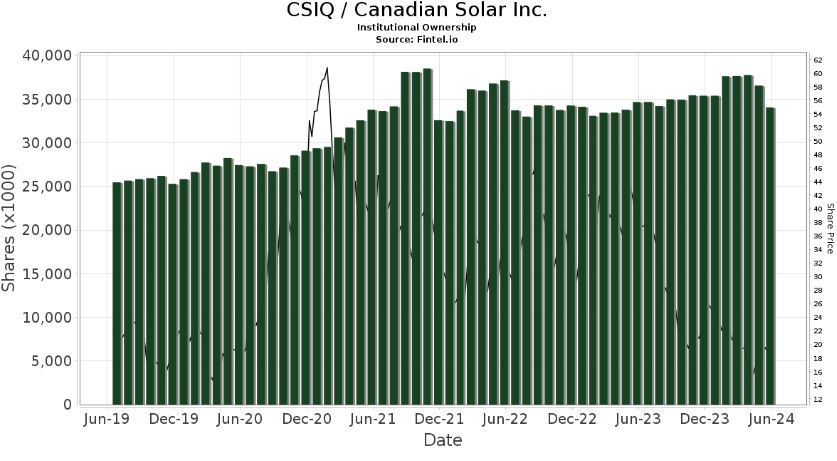

6. Canadian Solar Inc. (CSIQ)

Canadian Solar Inc. is a publicly traded firm that manufactures solar PV modules and operates large-scale solar projects.

Canadian Solar (NASDAQ: CSIQ) was founded in 2001 by Shawn Qu in Guelph, Ontario, Canada, and now has subsidiaries in over 24 countries across six continents. They manufacture solar PV modules, support solar energy installation, and work on various utility-scale power projects.

In November 2006, the company went public (Nasdaq: CSIQ) for $15 per share.

- PE Ratio (TTM): 6.82

- Revenue in 2023: $7.61 billion

- 5-Year Return: 15.67%

5-Year Chart Price History

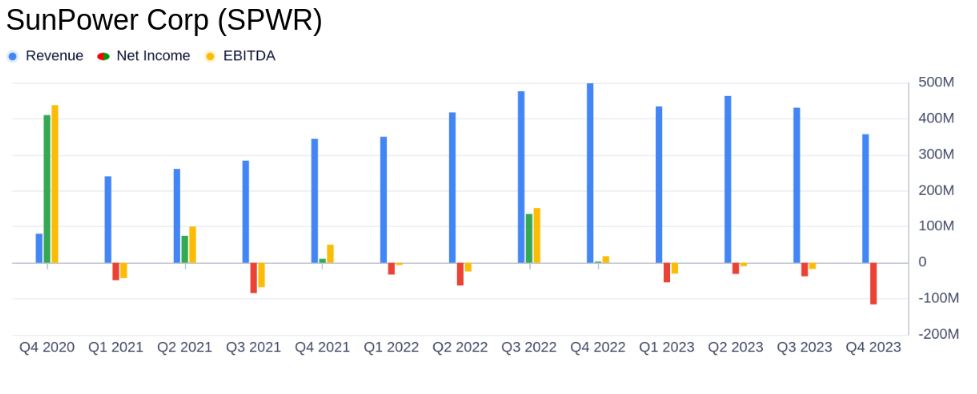

7. SunPower Corporation (SPWR)

SunPower Corporation is an American manufacturer of photovoltaic solar energy generation systems and battery energy storage technologies, particularly for residential use. Richard Swanson, an electrical engineering professor at Stanford University, started the corporation in 1985, with its headquarters in San Jose, California. Cypress Semiconductor obtained a majority interest in the company in 2002, and it increased until SunPower went public in 2005.

SunPower was started on April 24, 1985, by Richard Swanson, a Stanford University professor of electrical engineering.

Cypress began with an investment of $8 million and eventually invested $150 million, obtaining a majority stake in SunPower in 2002. The next year, Cypress chose Tom Werner as its new CEO.

- P/E Ratio: -5.65

- Revenue in 2023: $1.7 billion

5-Year Chart History

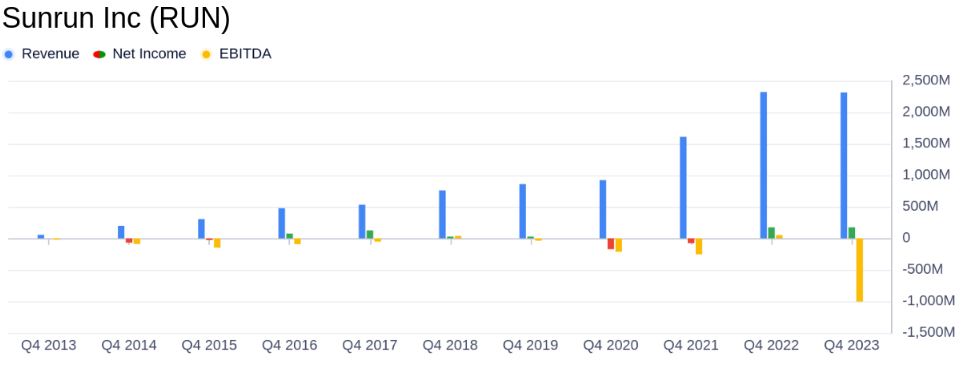

8. Sunrun Inc. (RUN)

Sunrun Inc. is a residential customer-focused American provider of battery energy storage products and photovoltaic systems. The company was founded in 2007 and is headquartered in San Francisco, CA.

In January 2007, Lynn Jurich, Ed Fenster, and Nat Kreamer co-founded Sunrun. The company’s business model consisted of either a lease or a Power Purchase Agreement (PPA), in which homeowners paid for electricity usage but did not purchase solar panels outright. This approach reduced the initial capital outlay required by the homeowner.

- P/E Ratio: -2.66

- Revenue in 2023: $2.25 Billion

5-Year Chart History

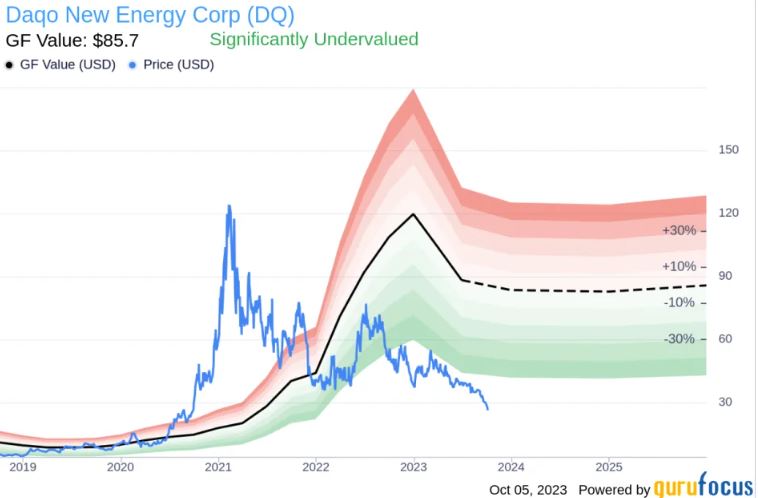

9. Daqo New Energy (DQ)

Daqo New Energy Corp. (NYSE: DQ) is a prominent maker of high-purity polysilicon for the worldwide solar PV sector. We produce and sell high-purity polysilicon to solar PV manufacturers, who then process it into ingots, wafers, cells, and modules for solar power solutions.

To make polysilicon, we use the chemical vapor deposition process, also known as the “modified Siemens process,” which includes updated hydrochlorination technology. We have also fully implemented the closed-loop system to produce high-quality polysilicon at a low cost. Currently, our annual polysilicon manufacturing capacity is 205,000 MT.

- PE Ratio (TTM): 9.40

- Revenue in 2023: $2.69 Billion

5-Year Chart History

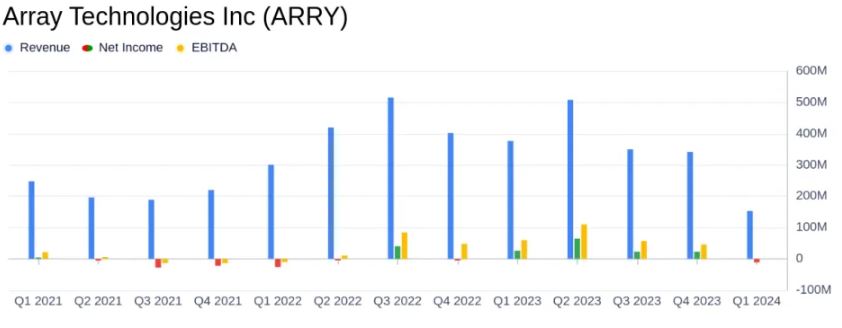

10. Array Technologies (ARRY)

Array Technologies, Inc. (Array) is a solar system and solution provider. The company makes and designs solar tracking systems. It also offers the DuraTrack HZ v3 solar tracker, Array STI H250, and Array OmniTrack. Array works with a lot of different companies, such as utilities, independent engineering firms, mechanical suppliers, and developers.

The corporation distributes its products throughout the Americas, Europe, the Middle East, and Africa. It has operations in Albuquerque, São Paulo, and Spain. Array is headquartered in Albuquerque, New Mexico, United States.

- P/E Ratio: 27.4

- Revenue in 2023: $1.58 billion

5-Year Chart History

Advantages of Investing in Solar Power Stocks

Some reasons to consider investing in a renewable energy source, such as solar power:

- Environmental Impact: Investing in solar power supports the transition to clean energy, reducing carbon footprints and promoting ecological sustainability, enhancing a company’s public image and attracting eco-conscious investors.

- Government Incentives: Many governments offer subsidies, tax credits, and favorable policies for renewable energy investments, enhancing the profitability and attractiveness of solar power stocks.

How to Buy These Stocks

1. Open a Brokerage Account:

- Choose a reputable online brokerage platform like E*TRADE, TD Ameritrade, Charles Schwab, Robinhood, or Fidelity.

- Complete the account opening process by providing personal information and financial details.

2. Fund Your Account:

- Deposit funds into your brokerage account using a bank transfer, wire transfer, or other accepted methods.

3. Research the Stocks:

- Use the brokerage platform’s research tools to analyze the stocks you’re interested in. Look at financial statements, analyst ratings, and market trends.

5. Monitor Your Investments:

- Regularly review your portfolio to track performance.

- Stay informed about market news and developments in the solar industry that could affect your investments.

FAQs-

Will energy stocks go up in 2024?

After a year of negative returns in 2023, energy stocks are off to a promising start in 2024.

Are solar power stocks a good long-term investment?

Yes, due to the increasing global emphasis on renewable energy, advancements in solar technology, and declining costs, solar power stocks have substantial long-term growth potential.

Why is First Solar (FSLR) considered a good investment?

First Solar is known for its strong balance sheet, innovative thin-film technology, and significant market share in the utility-scale solar sector, making it a stable investment option.

Disclaimer: Dear Readers, The information or service is provided solely for informational purposes and is not intended to serve as personal financial advice.